From EVs and batteries to autonomous vehicles and urban transport, we cover what actually matters. Delivered to your inbox weekly.

It’s the kind of number that grabs headlines: a brand-new electric vehicle for just $21,999. That’s what General Motors floated recently, sparking buzz across the auto world. A fully electric car at that price point could shift the entire EV market—and finally make electrification accessible to the masses.

But here’s the reality check: GM hasn’t actually launched a $21,999 EV. Not yet.

That figure is more like a North Star — a bold pricing target the company hopes to reach, not a vehicle currently in showrooms. Right now, it serves more as a statement of intent than a sticker on a real product.

So where does GM stand today? And what exactly is it doing to make EVs cheaper, faster, and easier to adopt? Let’s break that down.

At the moment, GM’s most wallet-friendly electric vehicle is the 2025 Chevrolet Equinox EV, which the company calls “America’s most affordable 300+ mile EV.” The base LT FWD model starts at $34,995, and with the $7,500 federal tax credit, the price drops to a much more competitive $27,495—putting it well within reach for many mainstream buyers.

It’s no slouch, either: the Equinox EV offers up to 319 miles of range, fast charging, and a full digital interface, plus a more SUV-like form factor that appeals to the U.S. market. It’s already gained momentum, with over 15,000 units sold in its first full quarter.

If leasing’s more your thing, GM is making that easy too — $289/month gets you behind the wheel of an Equinox EV.

Beyond that, the lineup is growing:

So while $21,999 is still out of reach, GM already has one of the most competitively priced EVs on the road, and it’s just getting started.

Making an EV for $21,999 requires rethinking how cars are built from the ground up. And in today’s EV economy, the biggest cost driver is the battery.

To bring down battery costs, GM is building an entire supply chain.

One of its biggest bets is a $3.5 billion joint venture with Samsung SDI in Indiana. The facility is expected to start production in 2027 and crank out up to 36 GWh of battery cells annually. These are next-gen prismatic cells with high nickel content, designed for improved energy density and lower cost per kWh.

There’s also Ultium Cells, GM’s long-running joint venture with LG Energy Solution, which already has operational or in-development sites in Ohio, Tennessee, and Michigan. These plants could collectively push GM past 130 GWh of annual cell capacity once fully online.

Beyond production scale, GM is also investing in battery tech. Its Warren prototype center in Michigan is working on LMR batteries — lithium manganese-rich chemistry that promises better performance and lower costs. It’s a big part of GM’s plan to deliver cheaper, denser batteries that can support a future wave of ultra-affordable EVs.

The goal is to have 500,000 EVs produced globally in 2025, with even more scale and savings kicking in later in the decade. When you’re building half a million vehicles a year, the math starts working in your favor.

Cheap EVs are only half the battle. If you can’t charge them easily, they’re not useful to most drivers. GM knows this and it’s investing accordingly.

First, the partnerships. GM has teamed up with EVgo to install 2,850 DC fast charging stalls across 45 U.S. markets, and it’s working with ChargePoint to roll out 500 ultra-fast chargers using the flexible Omni Port system (think: CCS and NACS compatibility without adapters).

It’s also cut a deal with Tesla, giving GM drivers access to the Supercharger network — a huge step for interoperability and public trust in the charging experience.

Then there’s the GM Energy initiative. Backed by $750 million in private capital, this division is tasked with building out a nationwide EV charging ecosystem, from interstate fast-charging corridors (via partnerships with Pilot Flying J) to high-end destination chargers with pull-through access and canopies.

The tech is fast, too. Some chargers in development can hit 500kW, adding hundreds of miles in just 15 minutes.

Why does this matter? Because range anxiety is still a real barrier for many would-be EV buyers. Without visible, reliable, fast charging infrastructure, a $21,999 EV doesn’t feel like freedom—it feels like a risk.

GM is betting that solving charging is the key to unlocking the mass market. And so far, they’re putting their money where their mouth is.

Building a $21,999 EV is tough. Doing it at global scale? That’s the real challenge. But GM isn’t shying away.

One market under the microscope is India. GM exited the country’s passenger car market in 2017, but it still has brand recognition — and the timing might be right for a comeback. India’s EV market is heating up, driven by government incentives, infrastructure growth, and rising demand for low-cost clean transport. GM’s push for affordable EVs could align perfectly.

But to make that work, GM would need to adapt the Ultium platform for the realities of emerging markets. That means smaller vehicles, cheaper batteries, localized supply chains, and pricing flexibility.

Right now, the plan is to build around 500,000 EVs in 2025 and ramp up from there. If GM can scale globally while keeping costs down, it could rewrite the global EV playbook.

In automotive, software is becoming just as important as sheet metal. And GM is investing heavily to stay competitive.

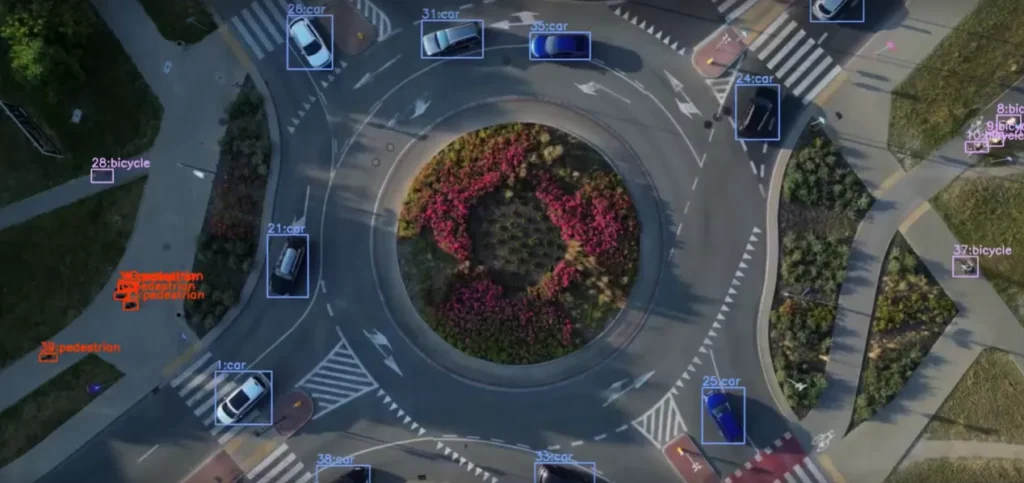

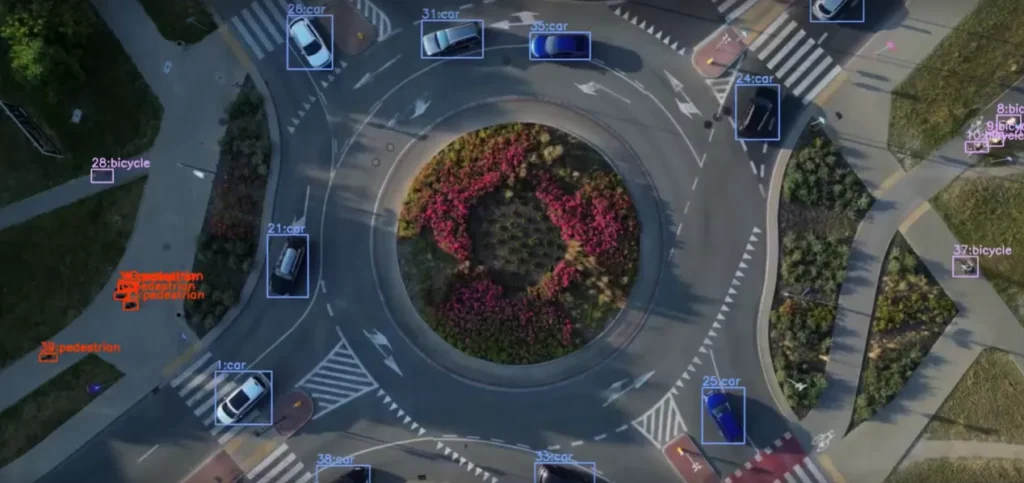

At the heart of its digital push is a partnership with NVIDIA. GM is building out future driver-assist systems using NVIDIA’s DRIVE AGX platform, including Blackwell, a chip architecture that supports mind-boggling performance: up to 1,000 trillion operations per second.

This powers the evolution of Super Cruise, GM’s hands-free driving system, which is on track to move from Level 2 assistance to Level 3 and eventually Level 4 autonomy.

Behind the scenes, GM’s vehicles run on the Global B software platform, which already enables over-the-air (OTA) updates. And next-gen updates will be cloud-native, making software upgrades as easy as a phone refresh.

All of this adds up to real money. GM expects up to $25 billion in annual revenue from software and services by 2030. From in-car apps to advanced features you can subscribe to, software is becoming a long-term profit engine.

So yes, the hardware might grab the headlines, but it’s the software that could define GM’s future.